a360inc: Delivering platforms

a360inc partnered with Avenga to design a platform for legal case management in the residential mortgage industry. The system’s goal was to challenge the existing market leaders and become a new industry standard.

Client

Industries

Services

Technologies

Introduction

Ayasdi provides revolutionary machine intelligence software that can process large amounts of complex data and help extract actionable insights.

It works with leading companies worldwide, including those from Fortune 500. It allows them to move from massive data to impactful solutions with the help of topological data analysis, automation, and machine learning.

Ayasdi reached out to Avenga to develop an application tailored specifically to the needs of financial analysts that could be integrated into the technical infrastructures of an enterprise. The idea was to launch a tool that, through Ayasdi’s predictive modeling, could help identify transactional frauds better, simplify trading decision-making, and solve major problems businesses face.

There are a few things that really caught my attention. They are very good communicators, which is absolutely a must, especially if you’re not in the same building, let alone in different time zones. If they’re facing an issue in a design area, they will have a very well-written JIRA ticket with concise information. It’s very natural and straightforward to understand what they want and to then respond.

Ronaldo Ama

EVP Product and Engineering, Ayasdi

Challenge

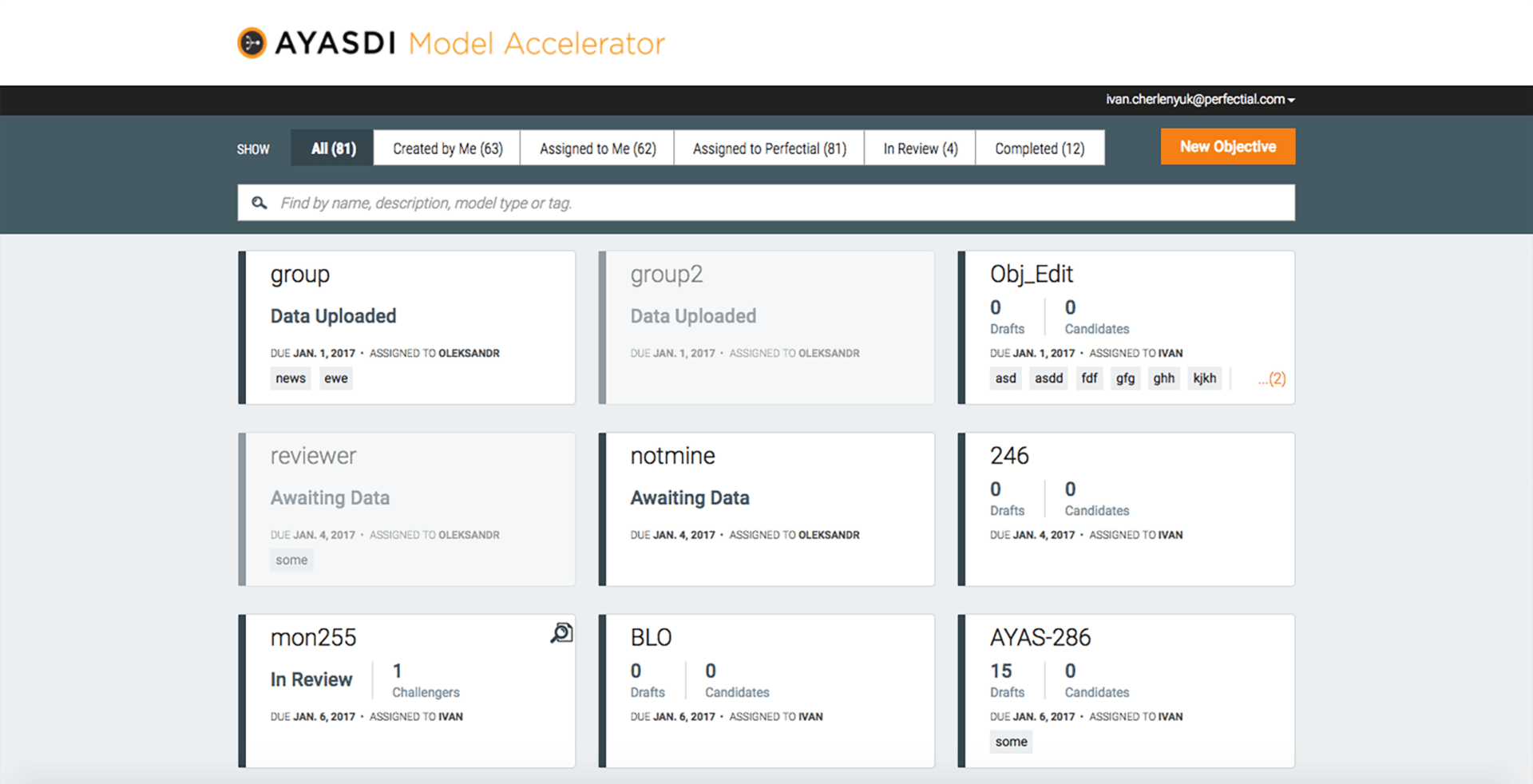

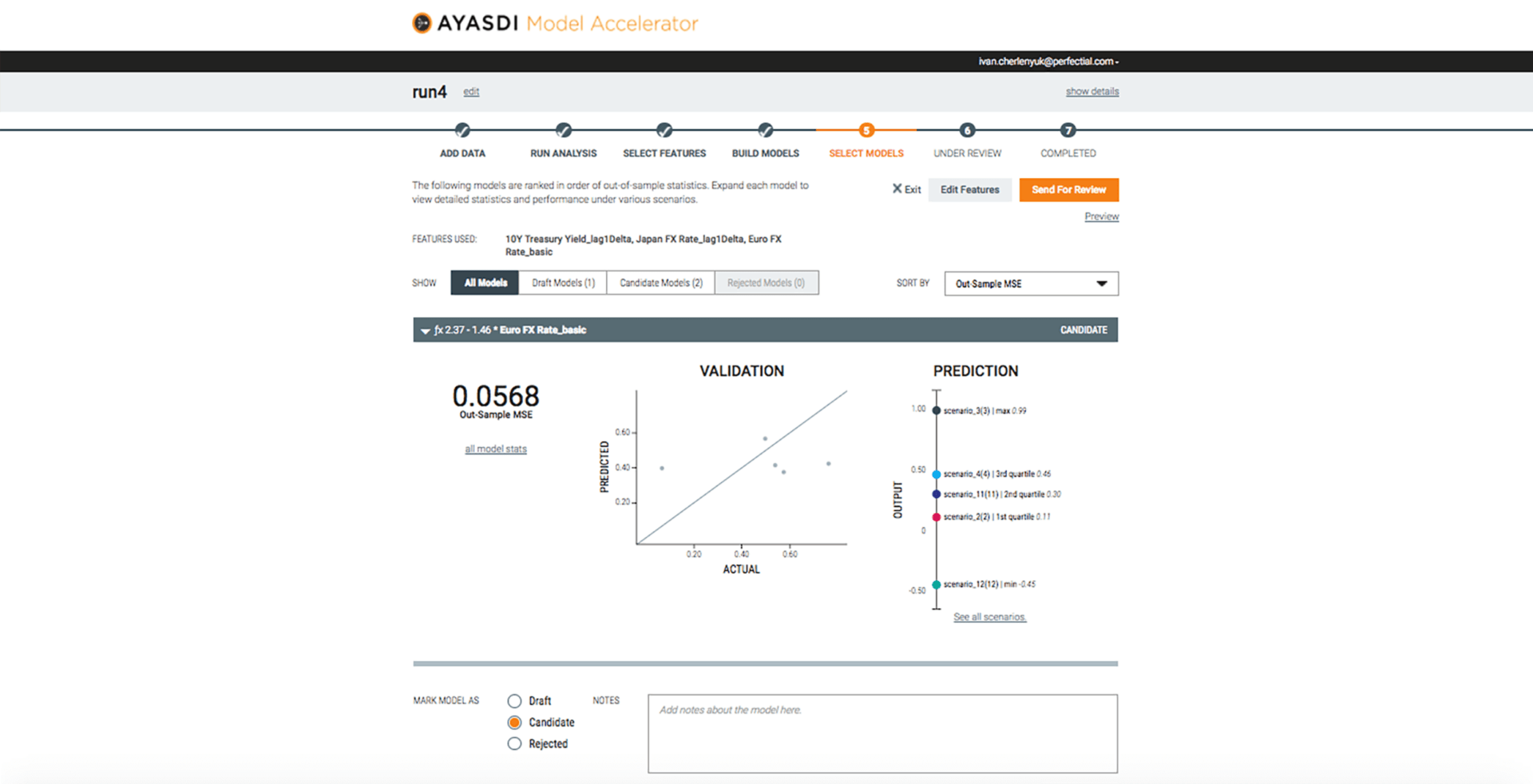

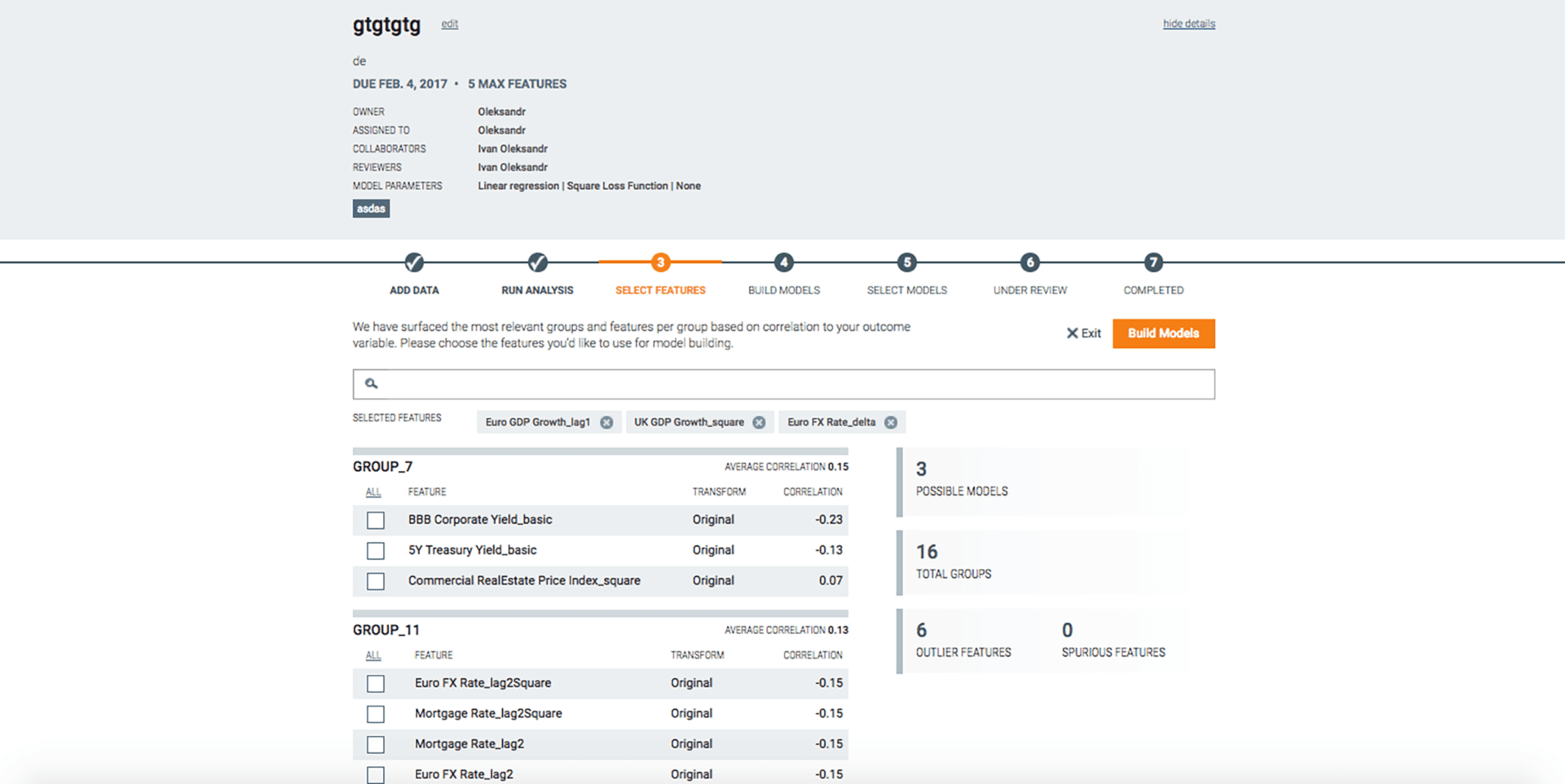

Avenga’s team was hired to build, test, and implement Modeler – an application that connects the Ayasdi machine intelligence platform with end users and is easily installable on enterprises’ infrastructures.

Integrating the app with Ayasdi’s internal services and establishing a Single Sign On connection with their existing Workbench platform was especially challenging due to Ayasdi’s unique infrastructure.

However, the result – the functional application – turned out to be of immense value to financial analysts; it visualizes data, which has been processed by Ayasdi algorithms and makes it much easier to comprehend.

Solution

Results

After delivering all the solutions, Ayasdi received the following:

Start a conversation

We’d like to hear from you. Use the contact form below and we’ll get back to you shortly.